How to Create a Monthly Budget (That Actually Works)

How to Create a Monthly Budget (That Actually Works)

If you’ve tried budgeting before and it didn’t stick, you’re not bad with money — and you’re not alone.

Most budgets fail not because people lack discipline, but because the budget itself is unrealistic, too restrictive, or disconnected from real life. A monthly budget that actually works should feel supportive, flexible, and sustainable — not like a punishment.

This guide will walk you through how to create a monthly budget you can stick to, even if budgeting hasn’t worked for you in the past.

Why Most Monthly Budgets Fail

Before creating a new budget, it helps to understand why previous ones didn’t work.

Common reasons budgets fail:

- They’re too strict or perfection-based

- They don’t allow room for real life

- They rely on willpower instead of systems

- They ignore emotional spending

- They’re copied from someone else’s lifestyle

A budget isn’t meant to control you. It’s meant to support your priorities and reduce stress. When a budget feels aligned with your life, it becomes much easier to follow.

What a Realistic Monthly Budget Actually Looks Like

A realistic monthly budget:

- Reflects your income and expenses — not an ideal version of them

- Includes flexibility for variable costs

- Allows room for enjoyment, not just bills

- Evolves over time

Think of your budget as a living document, not a rigid set of rules.

Step 1: Know Your True Monthly Income

Start with the amount of money you actually have available each month.

If your income is consistent:

- Use your average monthly take-home pay (after taxes)

If your income varies:

- Use your lowest average month, not your best one

- Any extra income can be used intentionally later (savings, debt, buffer)

This step is about being honest, not optimistic. A budget based on reality is far more effective than one based on “hopes.” Those hopes don’t pay your bills. If you are honestly assessing your income and expenses, you’re on the right track.

Step 2: List Fixed vs. Variable Expenses

Next, write down all your expenses and separate them into two categories.

Fixed Expenses

These stay mostly the same each month:

- Rent or mortgage

- Insurance

- Phone bill

- Subscriptions

- Minimum debt payments

Variable Expenses

These change month to month:

- Groceries

- Gas

- Utilities

- Dining out

- Personal spending

Many budgets fail because variable expenses are underestimated. Look at the last 2–3 months of spending if you can — real data is incredibly helpful here.

We provide Expense Trackers for free as well. They come in very handy if you have never actually monitored your monthly spending.

Step 3: Choose a Budgeting Method That Fits You

There’s no single “best” budgeting method — only the one you’ll actually use.

Here are three simple, beginner-friendly options:

1. The Simple Categories Budget

You assign spending limits to broad categories (housing, food, transportation, etc.).

✔ Easy to maintain

✔ Flexible

✔ Great for beginners

2. The Zero-Based Budget (Light Version)

Every dollar is assigned a purpose, but with built-in buffers.

✔ Very intentional

✔ Helpful for debt payoff

✔ Requires a bit more attention

3. The “Pay Yourself First” Budget

You prioritize savings first, then spend what remains.

✔ Low stress

✔ Ideal if you hate tracking

✔ Works best with stable income

Choose the method that feels supportive, not overwhelming.

Step 4: Build Flexibility Into Your Budget

This is the step most people skip — and the reason their budget collapses.

Your budget needs:

- A buffer category for unexpected expenses

- A realistic amount for fun or personal spending

- Permission to adjust month to month

If your budget doesn’t allow for life, it won’t survive life.

Instead of aiming for perfection, aim for consistency.

Step 5: Adjust and Improve Over Time

Your first budget will not be perfect — and it doesn’t need to be.

At the end of each month:

- Review what worked

- Notice what felt tight

- Adjust categories gently

Budgeting is a skill that improves with practice. Each month you’ll gain clarity, confidence, and control.

What to Do If You Overspend One Month

Overspending doesn’t mean you’ve failed.

It usually means:

- A category needs more money

- An expense was forgotten

- Life happened

Instead of giving up:

- Move money from another category

- Adjust next month’s numbers

- Keep going

Progress matters more than perfection.

How to Make Budgeting Feel Less Stressful

A few mindset shifts make budgeting far easier:

- A budget is a tool, not a test

- You don’t need to track every penny to succeed

- Small improvements add up

- Consistency beats intensity

When budgeting feels calmer, it becomes sustainable.

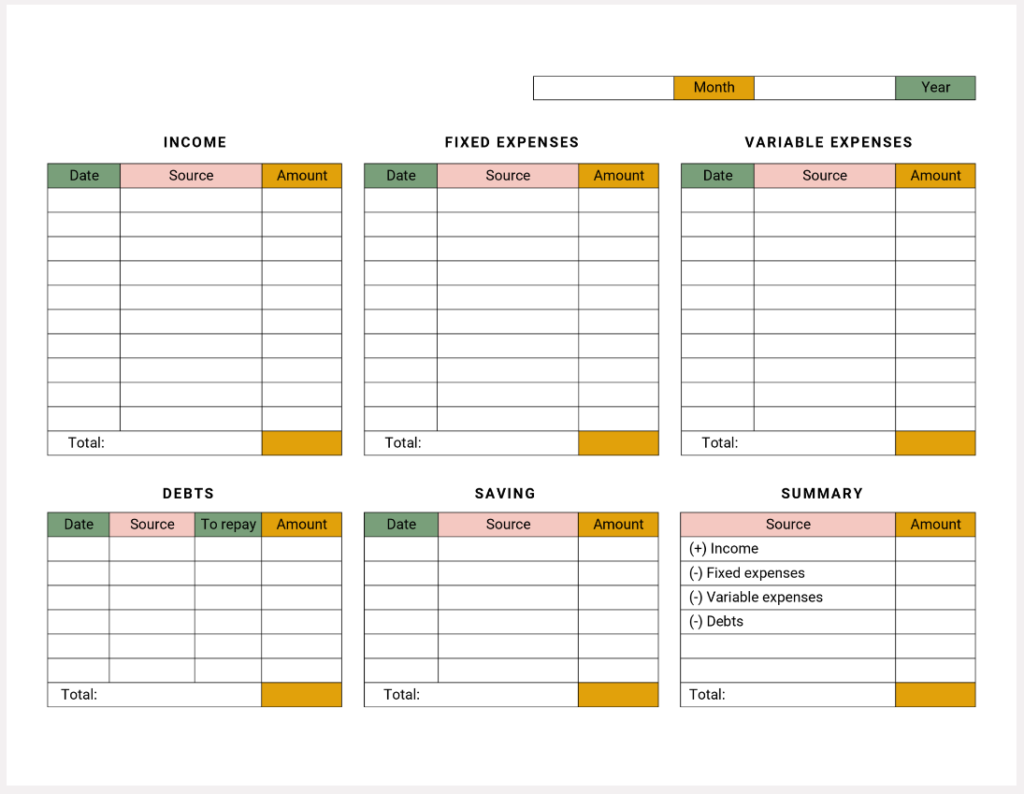

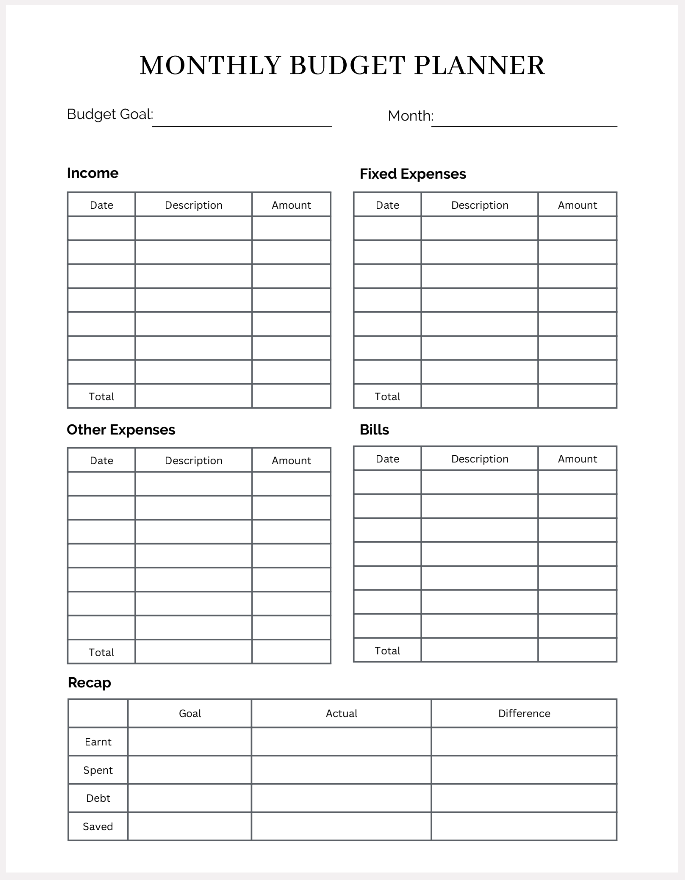

Use a Monthly Budget Worksheet (Free Download)

If starting from scratch feels overwhelming, using a simple worksheet can help.

A good monthly budget worksheet:

- Shows your income and expenses clearly

- Helps you spot patterns

- Makes adjustments easier

- Reduces decision fatigue

👉 [Download one of our free Monthly Budget Worksheets here]

(Designed to be realistic, flexible, and easy to use. We prepared two versions for you – horizontal and vertical. Choose the one that speaks to you.)

Final Thoughts

Creating a monthly budget that actually works isn’t about restriction — it’s about clarity.

When you understand where your money is going, you can make choices that support your life instead of reacting to stress.

Start simple. Be kind to yourself. And remember: a budget that works is one you’re willing to come back to.

Click here for the next article in this series: “Budgeting for Beginners”

Article 1 in a series of 24 articles

Privacy Policy | Terms & Conditions | Disclaimer | Cookie Policy