Budgeting for Beginners: A Step-by-Step Guide for Women

Budgeting for Beginners

If the word budgeting makes you feel anxious, overwhelmed, or like you’re already behind, you’re not alone.

Many women avoid budgeting not because they don’t care about money — but because budgeting has often been presented as strict, complicated, or unforgiving. The truth is, budgeting for beginners doesn’t need to be stressful or perfect. It just needs to be realistic.

This step-by-step guide is designed to help women create a simple, beginner-friendly budget that supports real life — not an idealized version of it.

What Budgeting Really Means (and What It Doesn’t)

At its core, budgeting is simply deciding where your money goes before it disappears.

Budgeting is:

- A planning tool

- A way to reduce financial stress

- A method for aligning money with your priorities

Budgeting is not:

- A punishment

- A measure of your self-worth

- A test you can fail

When you understand budgeting as a form of self-support rather than self-control, it becomes much easier to begin.

Why Budgeting Feels Hard at First

Budgeting often feels difficult because:

- No one taught us how to do it simply

- We’re expected to be perfect right away

- We compare ourselves to unrealistic examples

- Emotions are tied to money

If you’ve tried budgeting before and stopped, it doesn’t mean budgeting doesn’t work — it usually means the approach wasn’t right for you.

Step 1: Start With Your Real Monthly Income

The first step in beginner budgeting is clarity.

Write down your monthly take-home income — the amount that actually lands in your bank account after taxes.

If your income is:

- Consistent → use your average monthly pay

- Variable → use a conservative or lower average month

This step is about honesty, not optimism. A budget based on real numbers is far easier to stick to.

Step 2: List Your Fixed and Variable Expenses

Next, write down where your money currently goes.

Fixed Expenses

These usually stay the same:

- Rent or mortgage

- Insurance

- Phone and internet

- Subscriptions

- Minimum debt payments

Variable Expenses

These change month to month:

- Groceries

- Gas

- Utilities

- Dining out

- Personal spending

If you’re unsure about amounts, look at the last 2–3 months of bank statements. This isn’t about judging — it’s about understanding.

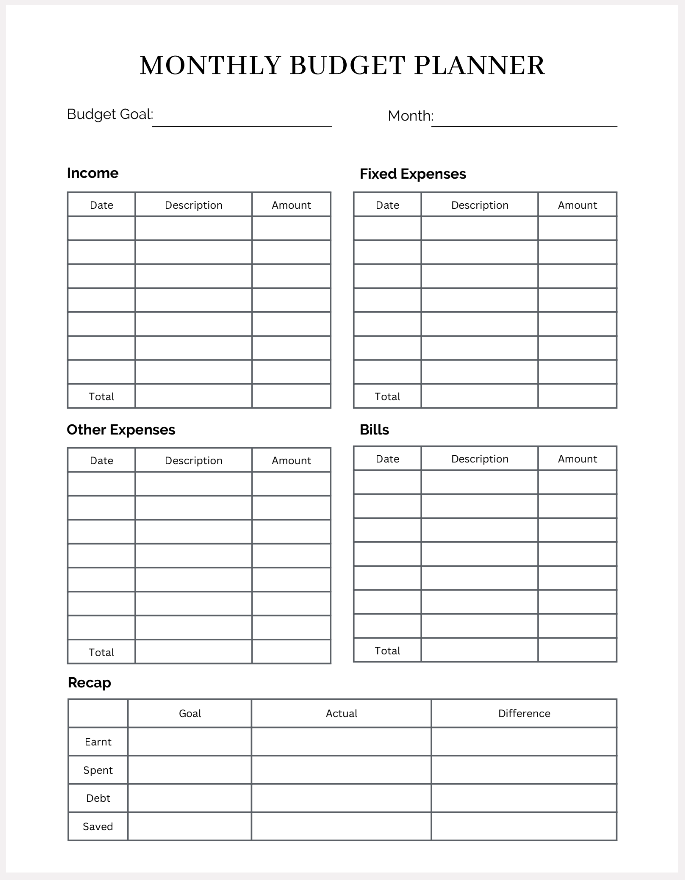

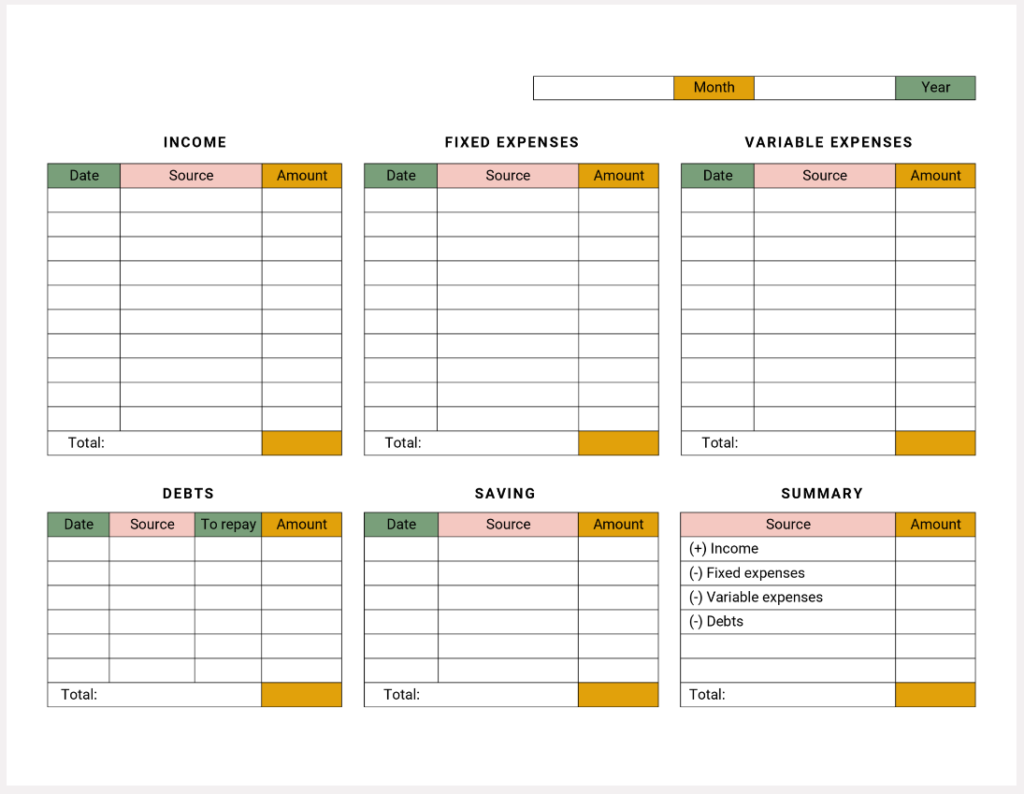

To download the Monthly Budget Planners pictured above, scroll further down in this article.

Step 3: Choose a Simple Budgeting Method

As a beginner, simple is better.

Here are three beginner-friendly budgeting methods:

The Simple Category Budget

You assign general spending limits to categories like food, housing, and transportation.

✔ Easy

✔ Flexible

✔ Great for beginners

The “Pay Yourself First” Method

You prioritize saving first, then spend what remains.

✔ Low stress

✔ Less tracking

✔ Ideal if you dislike details

A Gentle Zero-Based Budget

Every dollar has a job, but with built-in buffers. You think about what you want to save and need to spend at the beginning of each month, instead of simply spending until nothing is left or the month is finished.

✔ Intentional

✔ Helpful for debt payoff

✔ Requires a bit more attention

Choose the method that feels doable — not impressive.

Step 4: Create Your First Beginner Budget

Now it’s time to put the pieces together.

- Start with income

- Subtract fixed expenses

- Allocate realistic amounts to variable categories

- Leave room for flexibility

Your first budget does not need to be perfect. Its job is simply to give you a clear starting point.

Step 5: Expect to Adjust (This Is Normal)

One of the biggest beginner mistakes is assuming a budget should work perfectly right away.

Instead, expect to:

- Adjust categories

- Underestimate some expenses

- Learn as you go

Budgeting is a skill — not a personality trait. Each month you practice, it gets easier.

Common Budgeting Mistakes Beginners Make

If you want to avoid burnout, watch out for these common traps:

- Making categories too tight

- Forgetting irregular expenses

- Expecting instant results

- Giving up after one “bad” month

Progress comes from consistency, not perfection.

How to Make Budgeting Feel Less Overwhelming

A few gentle mindset shifts help immensely:

- Your budget is a guide, not a rulebook

- Small improvements matter

- You don’t need to track every dollar

- One month doesn’t define success

When budgeting feels calm, it becomes sustainable.

Use a Beginner Budget Worksheet (Free Download)

If creating a budget from scratch feels overwhelming, using a worksheet can help.

A beginner-friendly budget worksheet:

- Shows income and expenses clearly

- Reduces decision fatigue

- Makes adjustments easier

- Keeps everything in one place

👉 [Download Free Monthly Budget Worksheets for Beginners]

(Simple, realistic, and designed for real life. All versions pictured in this article are available to download for FREE. You don’t even have to sign up for our “Smart Money Updates” newsletter, but you’re welcome to :))

Final Thoughts

Budgeting for beginners isn’t about getting everything right — it’s about getting started.

Clarity leads to confidence. Confidence leads to better choices. And better choices, made consistently, create lasting change.

Start where you are. Use what you have. And take it one step at a time 💛

More articles like this:

How to Create a Monthly Budget (That actually works)

Privacy Policy | Terms & Conditions | Disclaimer | Cookie Policy